Proponents of the Emh Think Technical Analysts

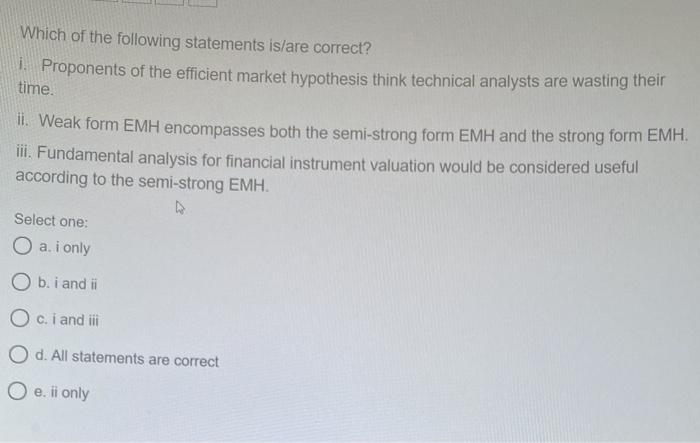

Proponents of the EMH think technical analysts _____. An implication of the efficient market hypothesis is that _____.

Efficient Market Hypothesis Emh Weak Semi Strong Strong Form

Review for Exam 2 Instructions.

. Should focus on resistance levels C. Are wasting their time. Are wasting their time.

Value-based investors believe that firms with high PE ratios __________. Are wasting their time. Should focus on support levels.

The efficient market hypothesis EMH is an economic and investment theory that attempts to explain how financial markets move. Proponents of the EMH think technical analysts __. Should focus on resistance levels C.

D are wasting their time. Should focus on resistance levels c. Should focus on relative strength B.

Proponents of the EMH think technical analysts A. Should focus on support levels D wasting their time AACSB. Asked Dec 31 2018 in Business by guru80.

It was developed by economist Eugene Fama in the 1960s who stated that the prices of all securities are completely fair and reflect an assets intrinsic value at any given time. Should focus on relative strength. Consider the ratio of Walmart to the retailer index on November 22 and November 25.

A short summary of this paper. Discover how to trade stocks. Should focus on support levels.

Should focus on the relative strength B. Should focus on resistance. On November 25 2005 the stock price of Walmart was 4025 and the retailer stock index was 60520.

Proponents of the efficient market hypothesis think technical analysts. Should focus on support levels D. Please read carefully The exam will have 25 multiple choice questions and 5 work problems You are not responsible for any topics that are not covered in the lecture note slides lecture 5 6 7 8.

Proponents of EMH believe that stock price changes are random variables. Asked Jan 2 2019 in Business by Chuckie. Should focus on relative strength b.

Are wasting their time 2. Technical analysts depend far more heavily on objective data-based approaches than the fundamentalists do. A positive abnormal return on the day positive earnings surprises are announced.

8 Full PDFs related to this paper. Are wasting their time. Proponents of the EMH think technical analysts _____.

Proponents of the EMH think technical analysts _____. Should focus on support levels d. Technical analysts consider a decrease in the putcall ratio as _____.

National Association of Certified Valuators and Analysts. Evidence supporting semi-strong form market efficiency suggests that investors should _____. Are wasting their time.

According to proponents of the efficient market hypothesis the best strategy for a small investor with a portfolio worth 25000 is probably to. Technical analysts attempt to predict future stock prices from historic stock prices. Should focus on support levels D.

Proponents of the EMH think technical analysts. Should focus on resistance levels. Rely on technical analysis to.

The National Association of Certified Valuators and Analysts NACVA supports the users of business and intangible asset valuation services and financial forensic services including damages determinations of all kinds and fraud detection and prevention by training and certifying. Discuss how you would test the strong form EMH. Cognitive errors may also explain the existence of market inefficiencies that spawn the systematic price movements that allow objective TA technical analysis methods to work.

Evidence supporting semi-strong form market efficiency suggests that investors should _________________________. Proponents of the EMH think technical analysts _____. One advocate for this approach is John Bollinger who coined the term rational analysis in the middle 1980s for the intersection of technical analysis and fundamental analysis.

Proponents of the EMH think technical analysts A. Are wasting their time. Should focus on relative strength B.

Nonzero alphas will quickly disappear. 1 Easy Learning Objective. Should focus on relative strength.

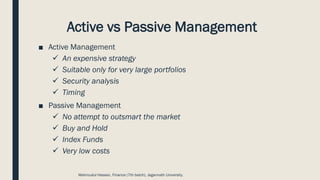

D are wasting their time. The weak form of EMH states that any future share price moves cannot be predicted using historical data that is to say future price moves are unrelated to historical data. Should focus on resistance levels C.

Why are these tests relevant. Should focus on financial statements. Earned higher average returns than firms with low PE ratios B.

Should focus on resistance levels. An advantage of technical analysis over fundamental analysis is that technical analysis. Are wasting their time.

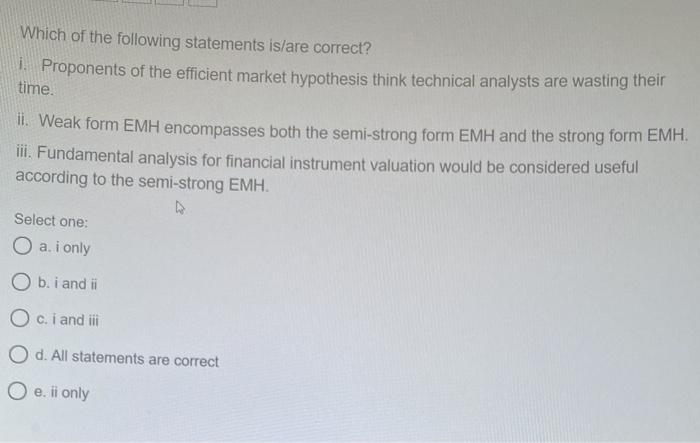

Use a passive trading strategy such as. This means that technical analysis will not work and that only fundamental analysis will allow investors to produce better than average returns. Proponents of the EMH think technical analysts _____.

08-01 Demonstrate why security price changes should be essentially unpredictable in an efficient market. Studies of positive earnings surprises have shown that there is A. Proponents of the EMH think technical analysts a b should focus on resistance levels should focus on support levels should focus on financial statements are wasting their time This problem has been solved.

Proponents of the EMH think technical analysts __________. Should focus on financial statements. Proponents of the EMH think technical analysts __________.

However many technical analysts reach outside pure technical analysis combining other market forecast methods with their technical work. Proponents of the EMH think technical analysts. EMH advocates reply that while individual market participants do not always act rationally or have complete information their aggregate decisions balance each other resulting in a rational.

On November 22 2005 the stock price of Walmart was 3950 and the retailer stock index was 60030. Should focus on relative strength B.

Solved Which Of The Following Statements Is Are Correct Chegg Com

Chp 11 Efficient Market Hypothesis By Mahmudul

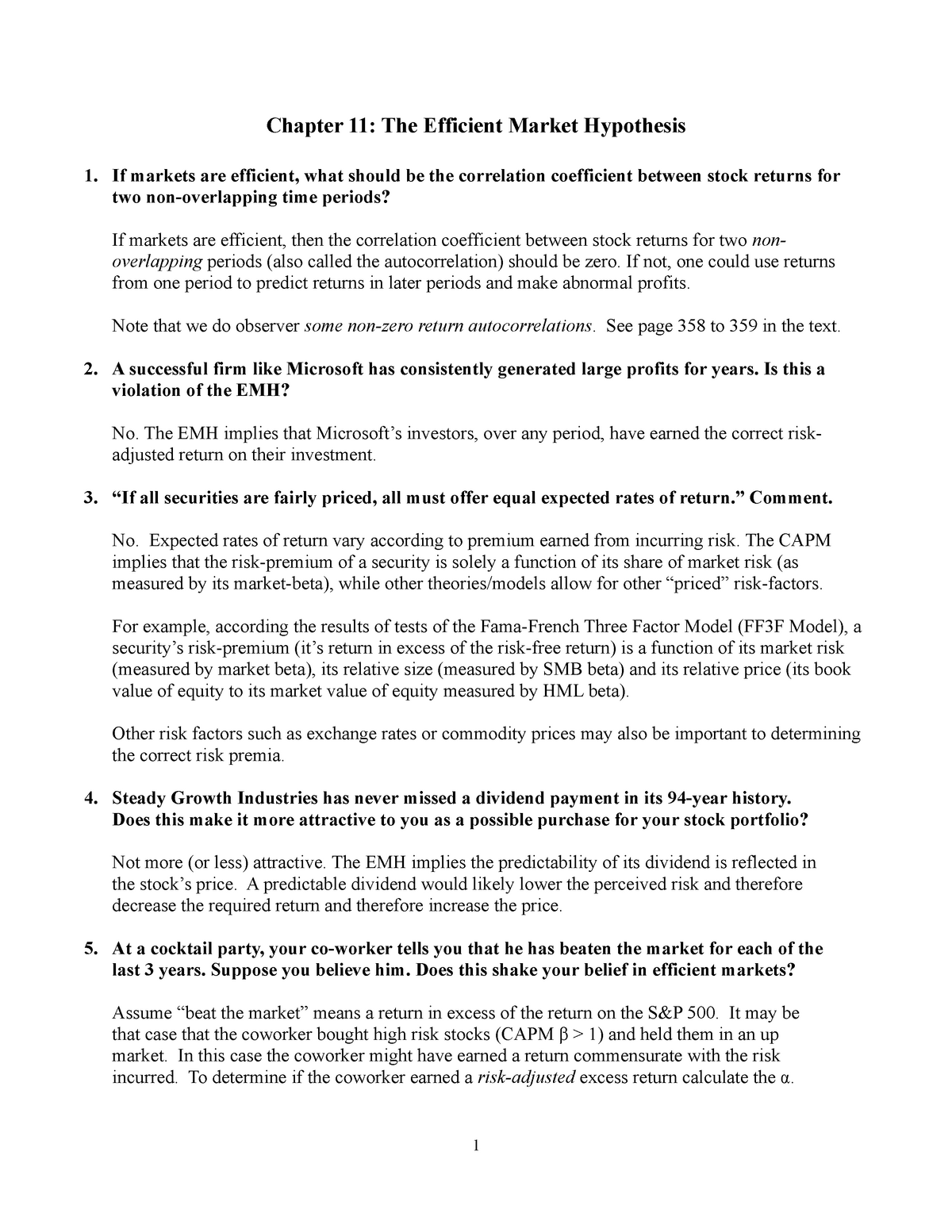

Chapter 11 The Efficient Market Hypothesis

Pdf The January Effect A Test Of Market Efficiency

Solved Proponents Of The Emh Think Technical Analysts Select Chegg Com

Pdf Market Efficiency And Technical Analysis Can They Coexist

Bkm Ch 11 Answers W Cfa Chapter 11 The Efficient Market Hypothesis If Markets Are Efficient What Studocu

Chp 11 Efficient Market Hypothesis By Mahmudul

Solved Proponents Of The Emh Think Technical Analysts A Should 1 Answer Transtutors

Efficient Market Hypothesis Wikiwand

Xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx Download Scientific Diagram

Weak Form Efficient Market Hypothesis Prepnuggets

Efficient Market Hypothesis Wikiwand

Efficient Market Hypothesis Pdf Efficient Market Hypothesis Stocks

Solved 39 Proponents Of The Emh Think Technical Analysts Chegg Com

Principles Of The Efficient Market Hypothesis Grin

What Is The Efficient Market Hypothesis Emh Ig Bank Switzerland

Comments

Post a Comment